FFS to FFV Transition

Fee-For-Value reimbursement is a way to reward and incentivize doctors to prevent costly illnesses and diseases and to manage chronic conditions while improving overall quality effectively.

While Medicare is making cuts in Fee-For Service reimbursements, it offers lucrative financial incentives for transitioning to a Fee-For-Value model of care.

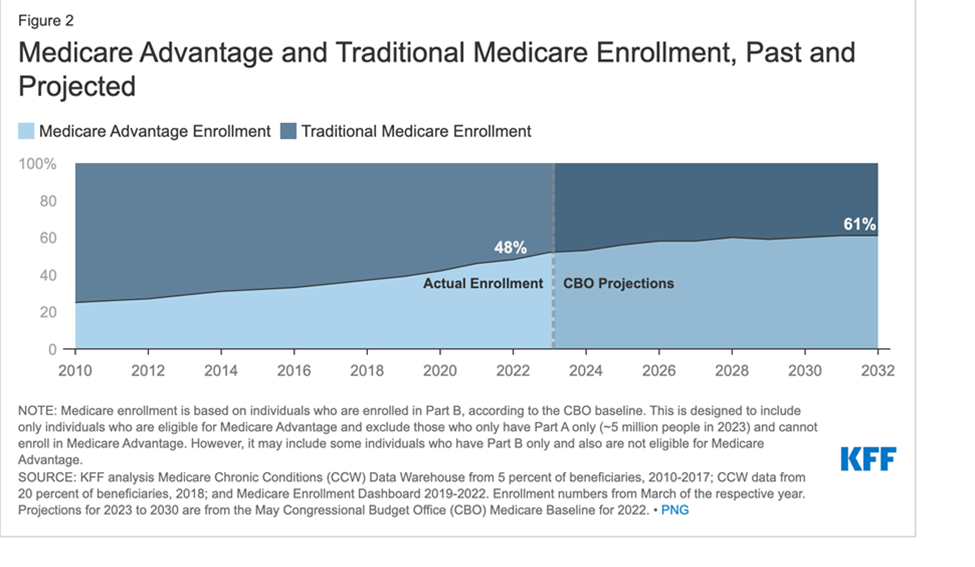

Fee for Value is not the Future; it is already here!

Making this transition takes work, though. It requires knowledge of statistics & systems to care for a population of patients. It even requires you to track and impact your patients' BMI & drug adherence.

That's too much to do when you're already on a Fee-For-Service treadmill. There needs to be more time.

That's why we're here. We have a long history of working with doctors. Our model is doctors-helping-doctors.

We've managed large patient populations of over 100,000 patients, and we've worked with solo practitioners to install the systems that will help achieve financial and clinical independence.

In our system, you keep doing what you’re doing. We provide Fee-For-Value services FOR YOUR PATIENTS FOR YOU. You even get paid more & get time back to spend with your family.

As an additional benefit, you keep the value you've created in your patient panel over years of hard work.

Most docs have been giving away their patient panels for free or for some unlikely future pay-off (like for local hospitals or some Wall Street firm).

They then turn your beloved patients back into the Fee-For-Service treadmill, denying them the attention and care you have provided for many years.

Your patients receive higher quality, more personalized care, helping them prevent disease and better manage any chronic condition.

Everything we teach is research-based. It shows the research evidence indicating the need for prevention for you & your patients. But we deal with more than WHY; we give you the details on HOW.

We give you the technical information on maximizing your practice performance in key programs such as HEDIS, CAPHS, HOS, & even clinical risk assessment & management.

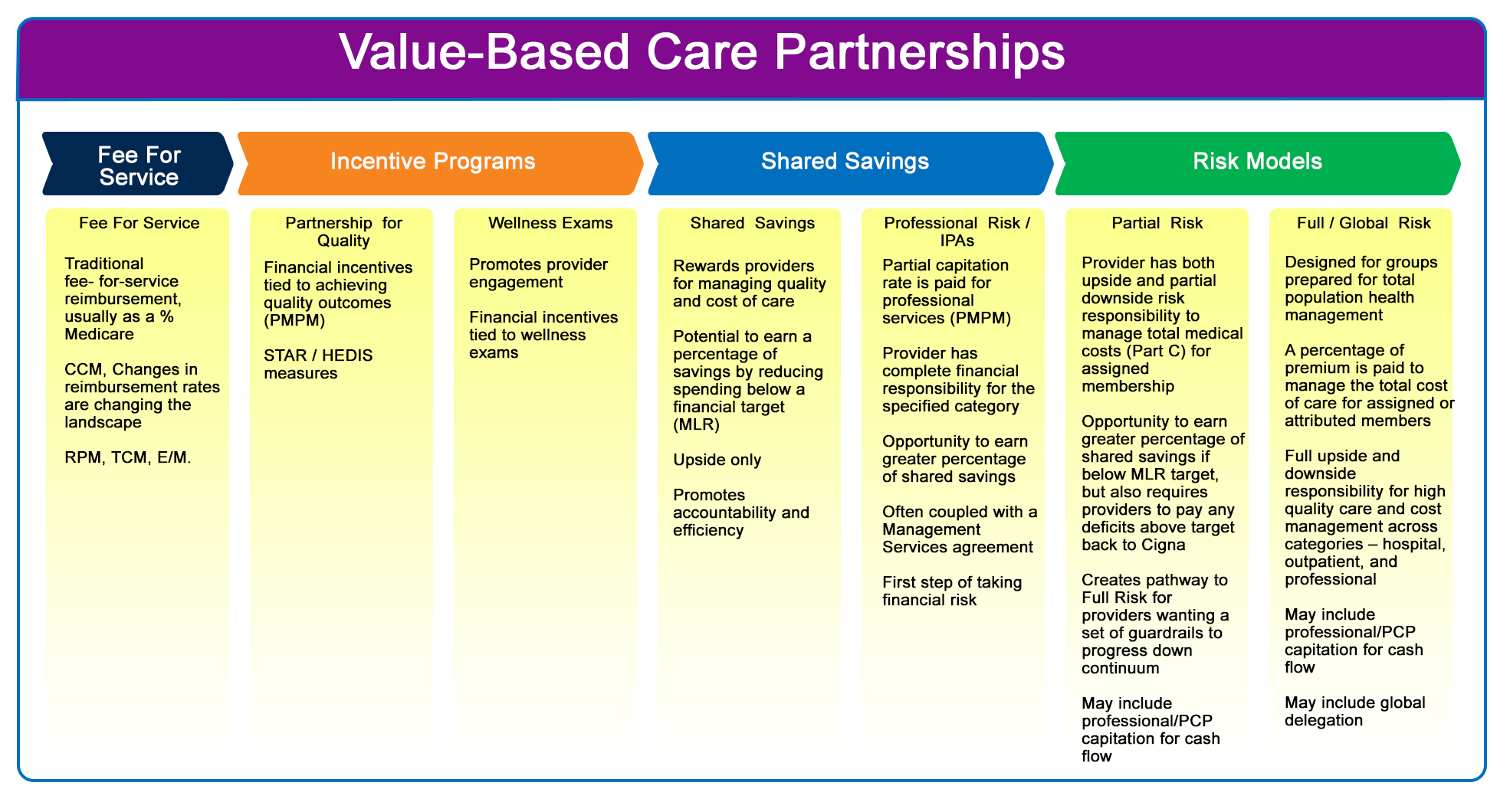

As you can see from the image, there is a major set of services & financial activities for each level of the transition from Fee-For-Service to Fee-For-Value. We’ll measure your success at each level. Then we’ll develop checklists of services that can be added.

Fee-For-Service

Even at the Fee-For-Service level, Medicare now provides excellent preventive program revenue opportunities (Like CCM). These programs have been to prevent patient disease states & therefore expensive hospitalizations. So setting up the programs is a win for your patients, for Medicare, & for you. We have implemented and run these programs for multiple environments. We’ll implement them for your patient population & share appropriate revenue back with you while minimizing activity by you & your staff.

In fact, most physician programs have found these programs to improve your clinic operations by streamlining patient call systems.

Fee for Value can be achieved by different methods, each of them has its requirements and characteristics and is usually based on the goals that you have in mind for your practices and patients, the resources at hand, and the amount of risk associated.

Partnership For Quality

Prior to the recent changes in CCM & RPM, this was the original first step into Fee-For-Value. It is characterized by Financial Incentives tied to achieving quality outcomes (PMPM). It starts with measuring & managing your STAR/HEDIS measures. & Again, we can fill in services where your team needs help. For example, we can find those patients that haven’t had A1c values or eye exams & contact them for evaluation.

Wellness Exams

Promote provider’s engagement as well as financial incentives are usually tied to wellness exams.

We will also evaluate your AWV (Annual Wellness Visit) performance as well. Again, our goal is to allow you to decide how much (if anything) you & your team do. We currently provide these for other providers using evisits or telemedicine programs. We can even assess the feasibility of using other local providers & home health visits where appropriate.

Shared Savings

This type of partnership rewards providers for managing quality and cost of care. It

provides the potential to earn a percentage of savings by reducing spending below a financial target (MLR). It is “Upside only”, meaning that providers assume no financial risk. It promotes accountability & efficiency, & most of all – quality of care. As we’ve mentioned before, almost anything that can be done in a primary care setting is more effective & efficient than doing it in a hospital setting. Again, we’re focusing on preventing progression of serious disease states.

Professional Risk/ IPAs

This partnerships involves partial capitation for professional services. In these programs, the provider has financial responsibility (risk) for his/her own professional services (again, this is a full professional capitation or PMPM program). These are often used with MSA (Managed Services Agreements). This is the first small step into taking financial risk.

Capitation programs are usually based upon knowledge & familiarity with the payor partner world. It also requires patient numbers; teaming with other doctors through partnership with our MSO allows market influence & arbitration.

Risk Models

Risk Management is the most advanced, technical, & complicated of the financial program models. But it is also creates the greatest benefit for you, your patients, & Medicare. Again, we’ve supported hundreds of providers (& hundreds of thousands of patients) through this challenging process.

Partial Risk

In these programs, the provider has both upside & partial downside risk responsibility to manage total medical costs (Part C) for assigned membership. This brings a greater opportunity to earn percentages of shared savings for costs below the MLR, but also requires partial payments when costs exceed the MLR. This is a pathway to full risk. It may include a professional or PCP capitation as well.

Full/Global Risk

This is designed for groups prepared for total population health management. A percentage of the premium is paid to manage the total cost of care for assigned or attributed members. This can include full upside & downside financial responsibility across all categories – hospital, outpatient, and professional. It usually includes professional capitation for cash flow purposes.

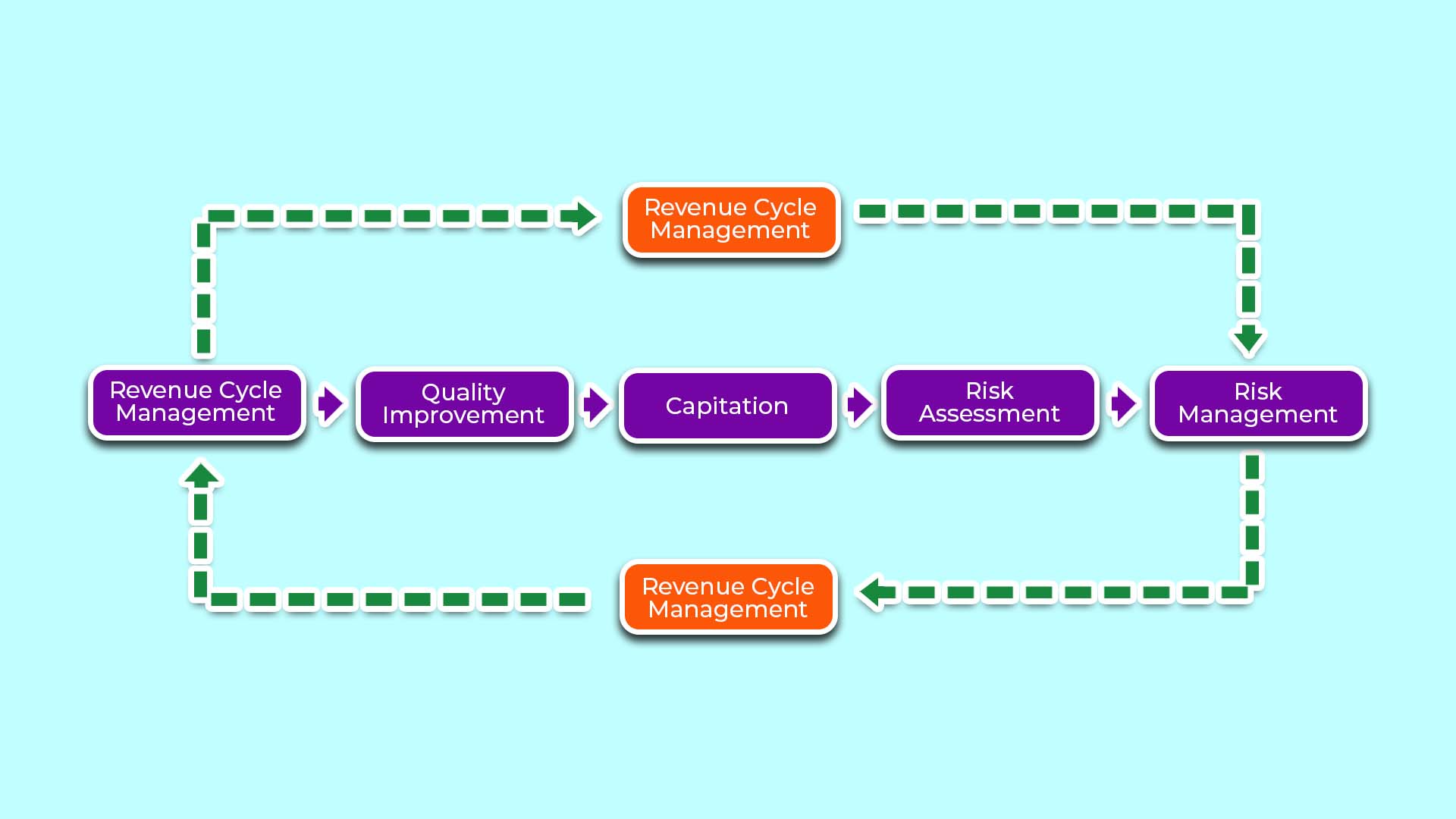

Revenue Cycle Management

Ready to find out more?

Call us at 859-721-1414 or email us. Your patients deserve it. Your family deserves it. You deserve it!